Key considerations and comprehensive comparison of prices.

The challenges faced by European energy markets over the past two years prompted various measures by national governments to ensure energy supply and maintain consumer affordability. Greece was no exception, as the national authorities implemented several reforms towards that direction both at a wholesale level but also on the retail energy market. The temporary amendments and the introduction of energy subsidies had been decided to phase out by the end of 2023, following the decline in the wholesale market, while a new electricity tariff scheme came into effect starting from January 1st, 2024.

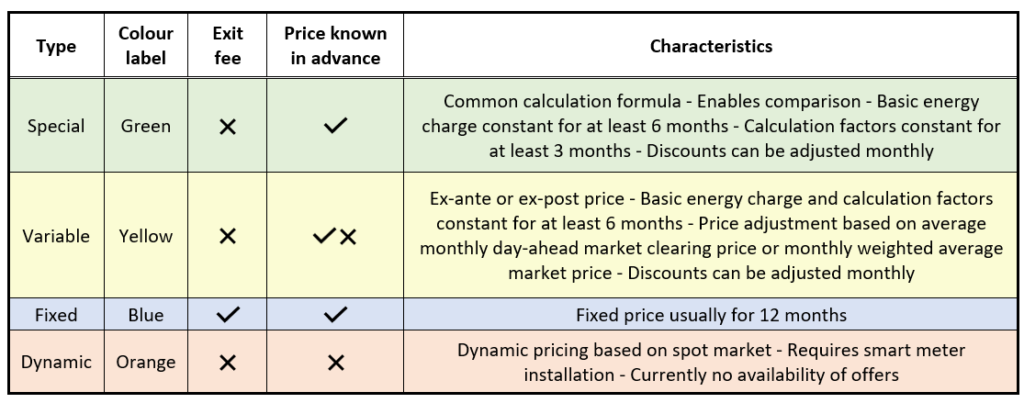

Electricity consumers in Greece have been notified about their transition to the “special tariff” of their existing electricity supplier starting from January. While this switch was the default option for all electricity consumers except those with a fixed tariff, the final choice was still in their hands to either accept the switch or explore other offers in the market. The switch was mainly decided because their existing tariff, including any contractual details, would come to an end in January, replaced by new tariff structures. In reality, not all types of tariffs were new, as the variable tariffs, which are being adjusted based on the wholesale price, already existed prior to energy crisis and had been temporary suspended to facilitate consumers’ choice and minimise their exposure to the wholesale market during a period of extraordinary high prices.

The new retail electricity market scheme established the “special tariff”, mandatory for all suppliers. Its main advantage is that the final price becomes known on the 1st day of each month, making it easily comparable for consumers. Additionally, colour labels have been assigned for different tariff categories to enhance transparency and consumer awareness.

Table 1: Summary table of tariff types and their main characteristics

On the other hand, the introduction of various tariff types with complex formulas, including price adjustment mechanisms, has added extra complexity to the market. The “special tariff” has been introduced to partially offset this burden for consumers as it enables comparability at the start of each month, however, it offers only partial price predictability for the future months. Furthermore, variable tariffs may offer competitive prices but vary significantly in characteristics and calculation formulas, providing only minimal comparability.

The subsequent section of this article will delve into the new retail market, breaking down the differences between the available tariffs with the scope of explaining their aspects and provide a comparison of current prices and their potential future development. The analysis considers:

- A typical residential customer consumption profile

- All available tariffs offered by the 3 largest electricity suppliers (based on their market share), as of January

- For the tariff calculations, the monthly average day-ahead or monthly weighted average market price have been utilised

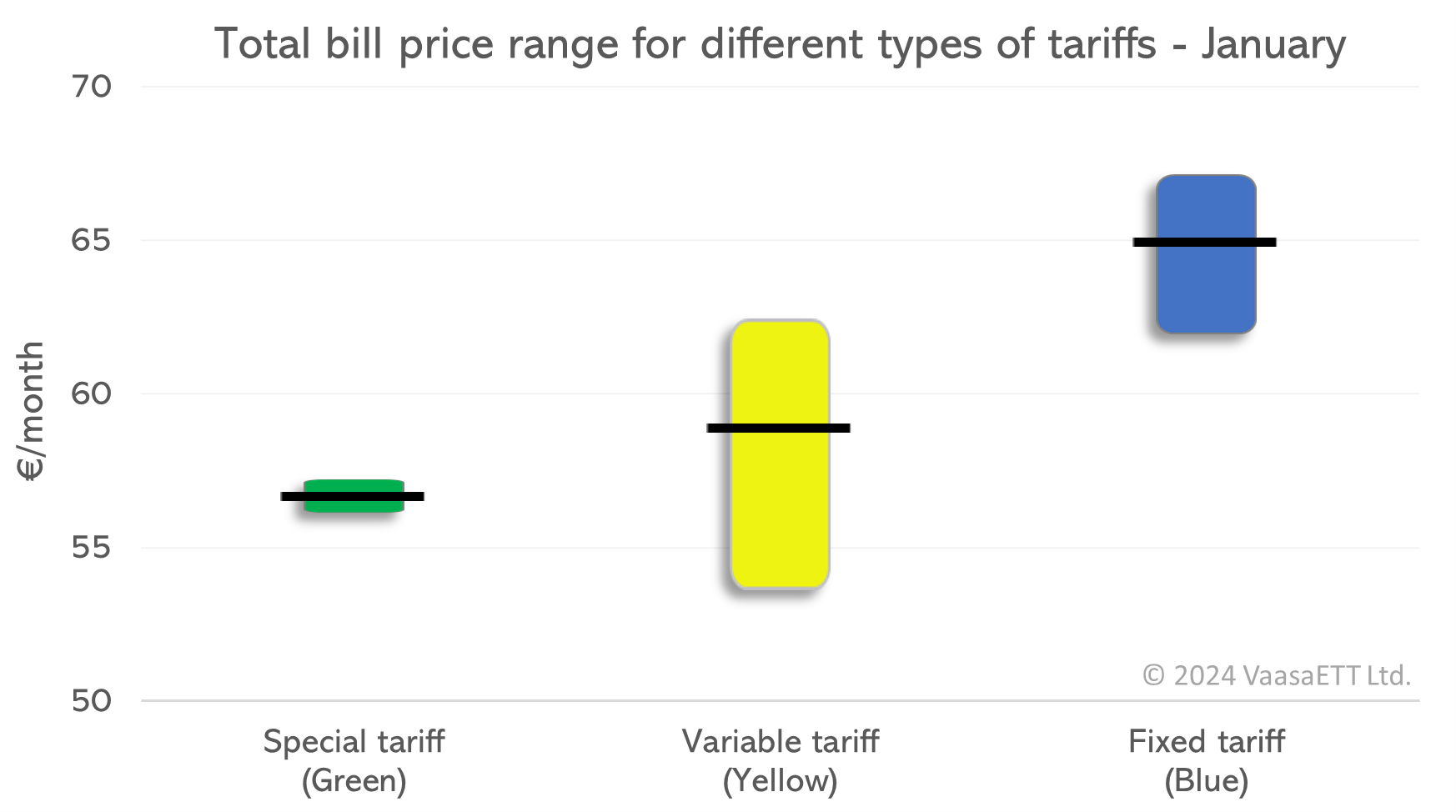

Figure 1 illustrates the total monthly bill for different types of offered tariffs, as of January 2024. The analysis highlights that the cheapest option available in the market was a yellow tariff, for the first month of its implementation. Being on this option, compared to the cheapest green, could save 2.5 € for the first month, while it amounts to 8.3 € when compared to the cheapest blue offer.

Figure 1: Comparison of total bill price range for different types of tariffs, as of January 2024

It is observed that variable tariffs (yellow) exhibit remarkable differences both in their calculation method but also in their final price, which is translated into the wide range of prices that they offer. In general, yellow tariffs showed on average a higher price than the green ones, however there were cheaper individual options available. A consumer would pay 9 € less for choosing the cheapest yellow option, in January, compared to the most expensive yellow one. The primary focus of discussions among Greek electricity consumers revolves around the tariff type (colour) selection, however, the graph indicates that substantial savings can be also achieved by choosing the most suitable offer within the same tariff category.

Green tariffs showed the smallest price dispersion, illustrating minimal variation among suppliers in terms of pricing for the special tariff. Given that the green tariff serves as the primary means of comparing suppliers in advance, the limited price differentiation can be attributed to the suppliers’ intention to offer the most competitive price within this category. Indicatively, the difference between the cheapest and most expensive green tariff offered by the 3 largest suppliers in January was merely 1 €.

Fixed price (blue) tariffs are currently at the upper end of offered prices, with the cheapest blue offer nearly reaching the most expensive yellow offer level. This pricing dynamic is a result of fixed prices incorporating a risk premium which consumers are obliged to pay to the supplier for having a stable price despite any potential wholesale market fluctuations. Typically, offered fixed price contracts tend to be higher during the winter period, given that wholesale prices are relatively high. Nevertheless, they offer price stability and predictivity, while protecting consumers in cases of unexpected rise in the wholesale market.

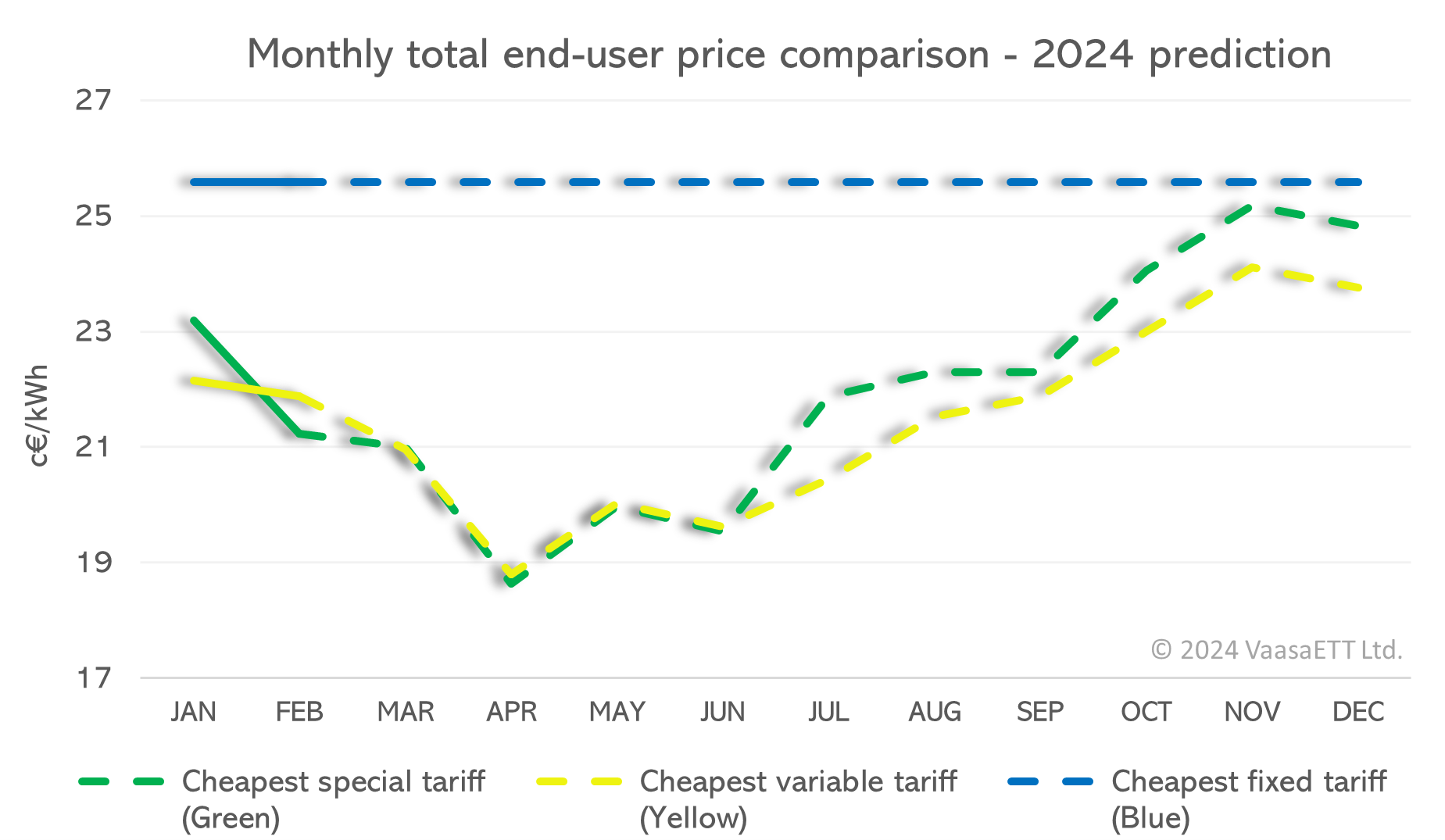

Moving beyond the initial comparisons during the first month of implementation of the new retail market scheme, it is interesting to explore the annual development of the different tariff types to facilitate a more comprehensive understanding. For the purpose of this analysis, VaasaETT’s in-house wholesale price prediction models have been utilised and the prices have been estimated based on available information on currently existing offers. In practice, suppliers can incorporate new offers to their portfolio going forward and modify discounts on existing tariffs to make them less or more attractive compared to the competition.

Figure 2 shows the monthly development of end-user price predictions per tariff type, during 2024. Green and yellow tariffs are largely dependent on the wholesale market price development, while consumers opting for a blue tariff will pay a fixed price throughout their contract duration.

Starting from January, yellow tariffs offered the cheapest option, at 22 c€/kWh. In February, the expected decline of wholesale prices will lead to the cheapest green tariff being the least expensive option in the market by almost 0.6 c€/kWh. Moving into the spring months, the cheapest green and yellow tariffs are projected to reach similar levels. However, the price prediction shows an increasing trend during the second half of the year which leads to notable differences, with yellow tariffs once again emerging as the most affordable option. On the contrary, the analysis indicates that consumers who chose a fixed blue tariff in January will be paying more compared to the alternatives throughout the year, assuming no extraordinary surge in wholesale prices. Consequently, some suppliers have already announced new fixed tariffs with a lower price, starting from February.

According to the analysis, being on the cheapest yellow tariff throughout the year, in comparison to choosing the cheapest green option, results in annual savings of 14 €. Furthermore, if compared to the most expensive yellow option, the annual savings are estimated to exceed 120 €, constituting 20% of the total bill. This underscores the wide price range among yellow offers and further highlights the significant potential for savings among consumers, emphasizing the importance of regular comparison of available offers.

Figure 2: Monthly (all-in) end-user price comparison for different types of tariffs, based on 2024 price predictions

In general, the pricing model of green tariffs entails a decrease whenever there was a declining trend in the wholesale market between the previous two months, from the month of consumption. On the other hand, yellow tariffs are being price adjusted either based on the wholesale price of the month of consumption or based on the wholesale price of the previous month, for ex-post and ex-ante tariffs, respectively. As a result, the thorough comparison of all available options in the market, especially if taking into account their future evolution, requires the inclusion of multiple factors, complicated calculations and estimation of wholesale prices, adding complexity for the typical consumer to understand and identify the most suitable option for their benefit.

VaasaETT, in collaboration with the Austrian energy regulator (Energie-Control) and the Hungarian Energy and Public Utility Regulatory Authority (MEKH), is closely following the developments of retail prices across Europe on a monthly basis through the Household Energy Price Index (HEPI) project. To stay always up to date with residential retail markets, subscribe to the HEPI newsletter for free.

0

0