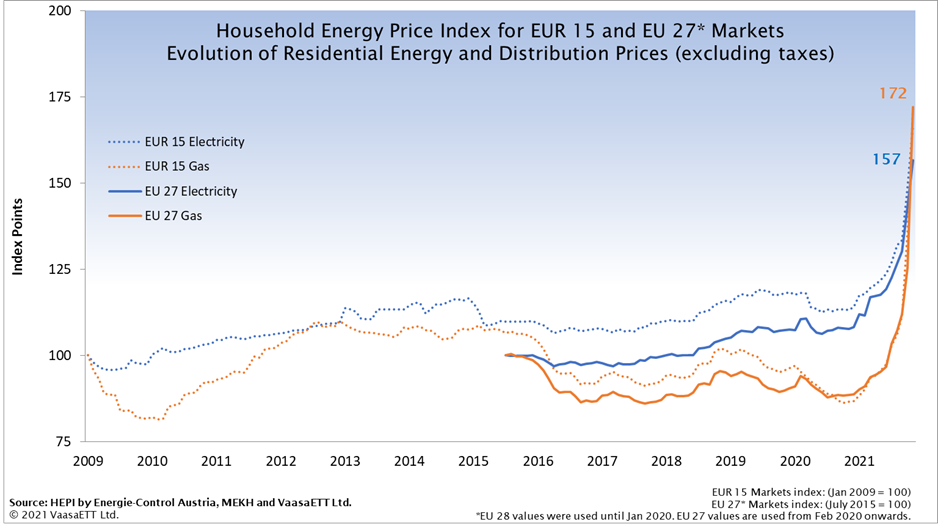

Europe is experiencing unprecedented retail energy prices, a crisis pervading the continent, driven in no small part by gas supply issues, demand growth and speculation. In the space of less than a year – accelerating rapidly in recent months – European households have seen a near doubling of retail gas prices and a 50% increase in retail electricity prices[1]. The burden on consumers, especially more vulnerable segments, will soon bite hard as winter bills start arriving. For those with wholesale indexed and especially real-time prices the impact will be worse still. These and other findings, released today by the Household Energy Price Index project provide the most vivid, detailed and up-to-date view of the current retail price crisis hitting European households right now.

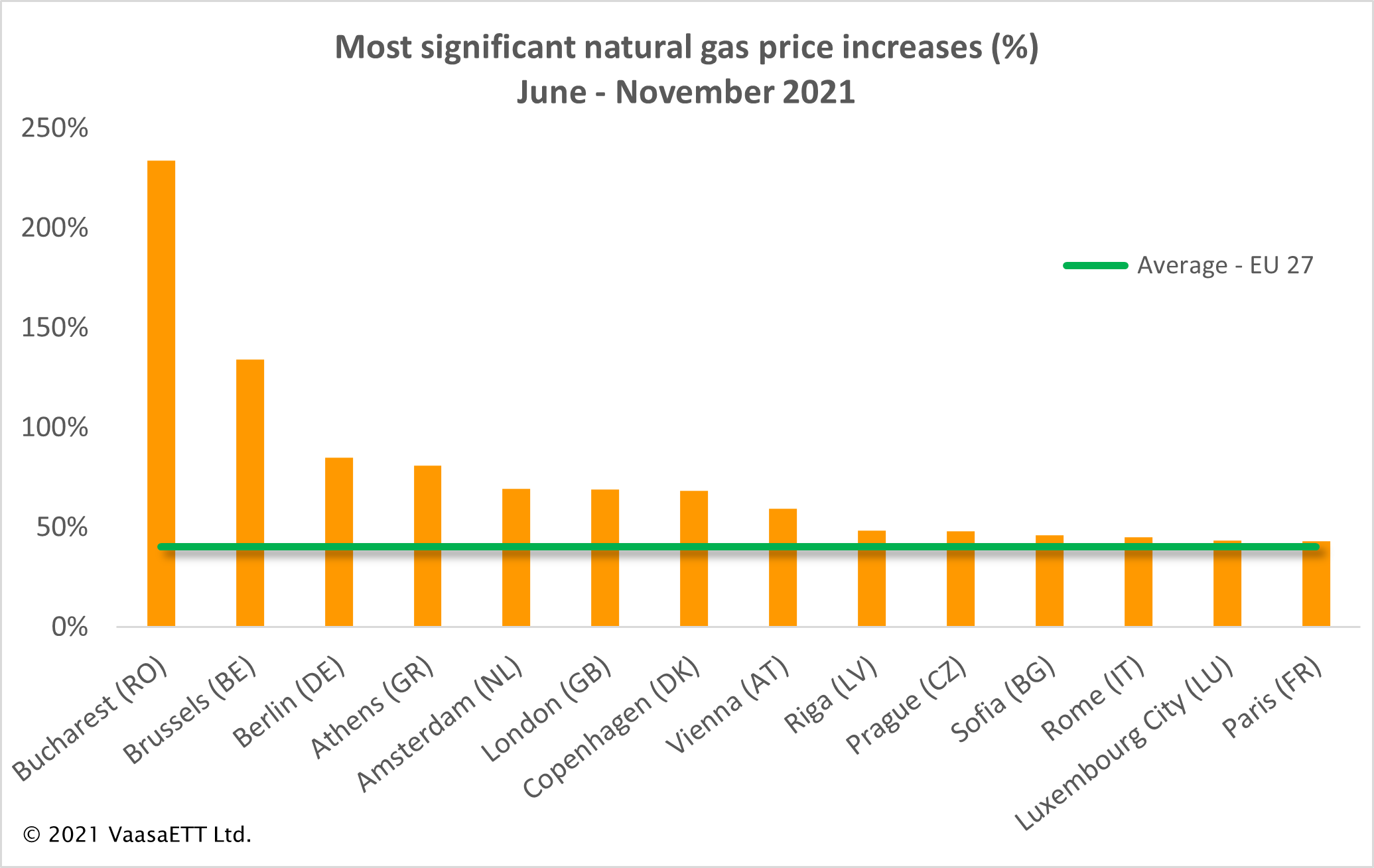

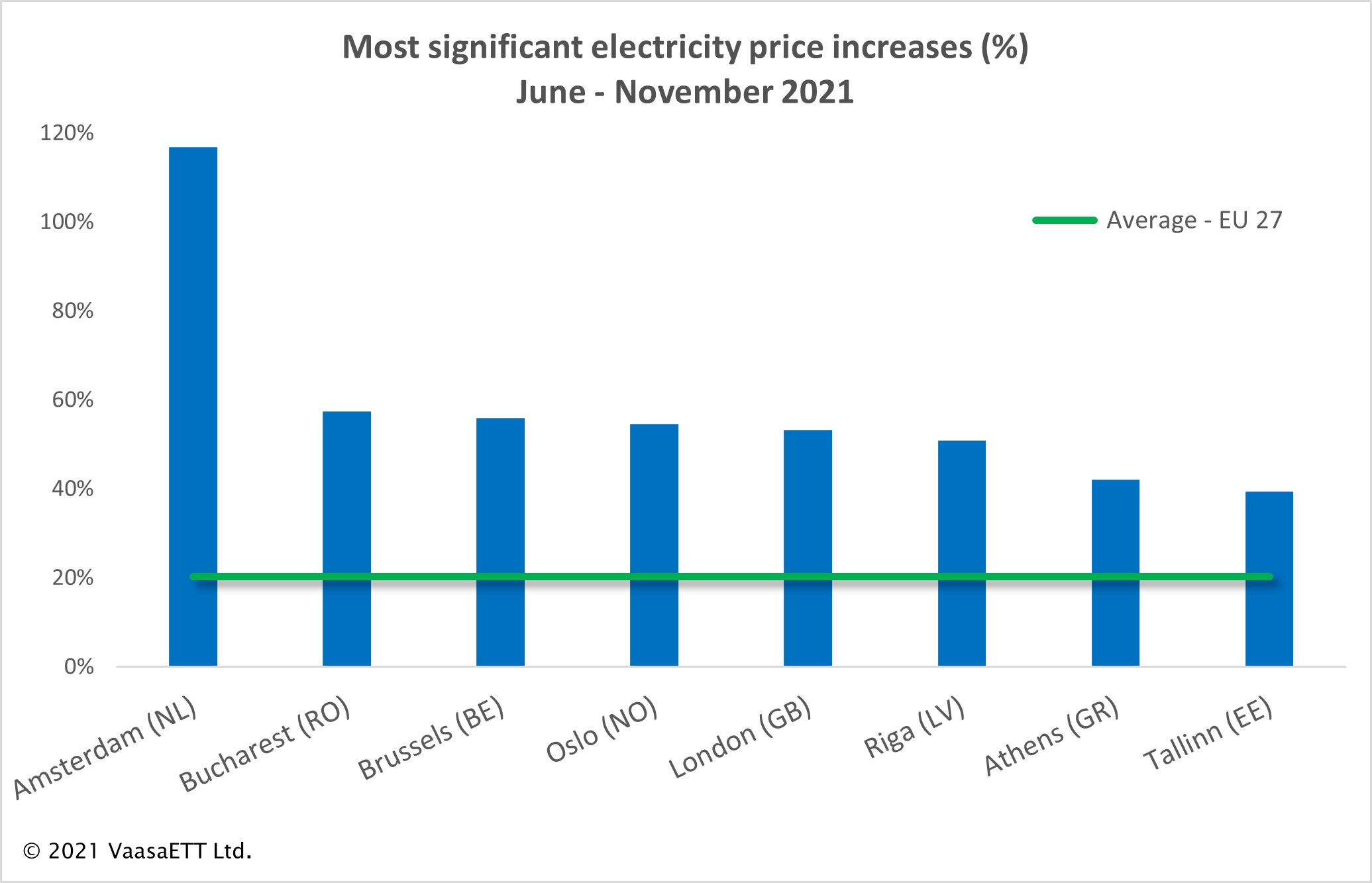

Looking a little deeper it becomes apparent that while few markets have been spared, some have been affected disproportionately, with Romania (Bucharest) especially impacted for gas and the Netherlands (Amsterdam) for electricity. Only a handful of markets, mostly those with predominantly regulated retail prices, have avoided or bucked the trend – so far at least – most notably Poland (Warsaw) which saw a 9% fall for electricity post November 2020. Perhaps interestingly, there appears to be little geographical pattern to the impact and even those markets without gas in the mix, such as Norway (Oslo), have seen significant electricity price increases.

It is important to note here that there have been numerous price controls and consumer protections implemented by authorities to limit prices or their impact. These measures will be discussed in later articles.

The following graphs show selected all-in (whole bill) price increases by market.

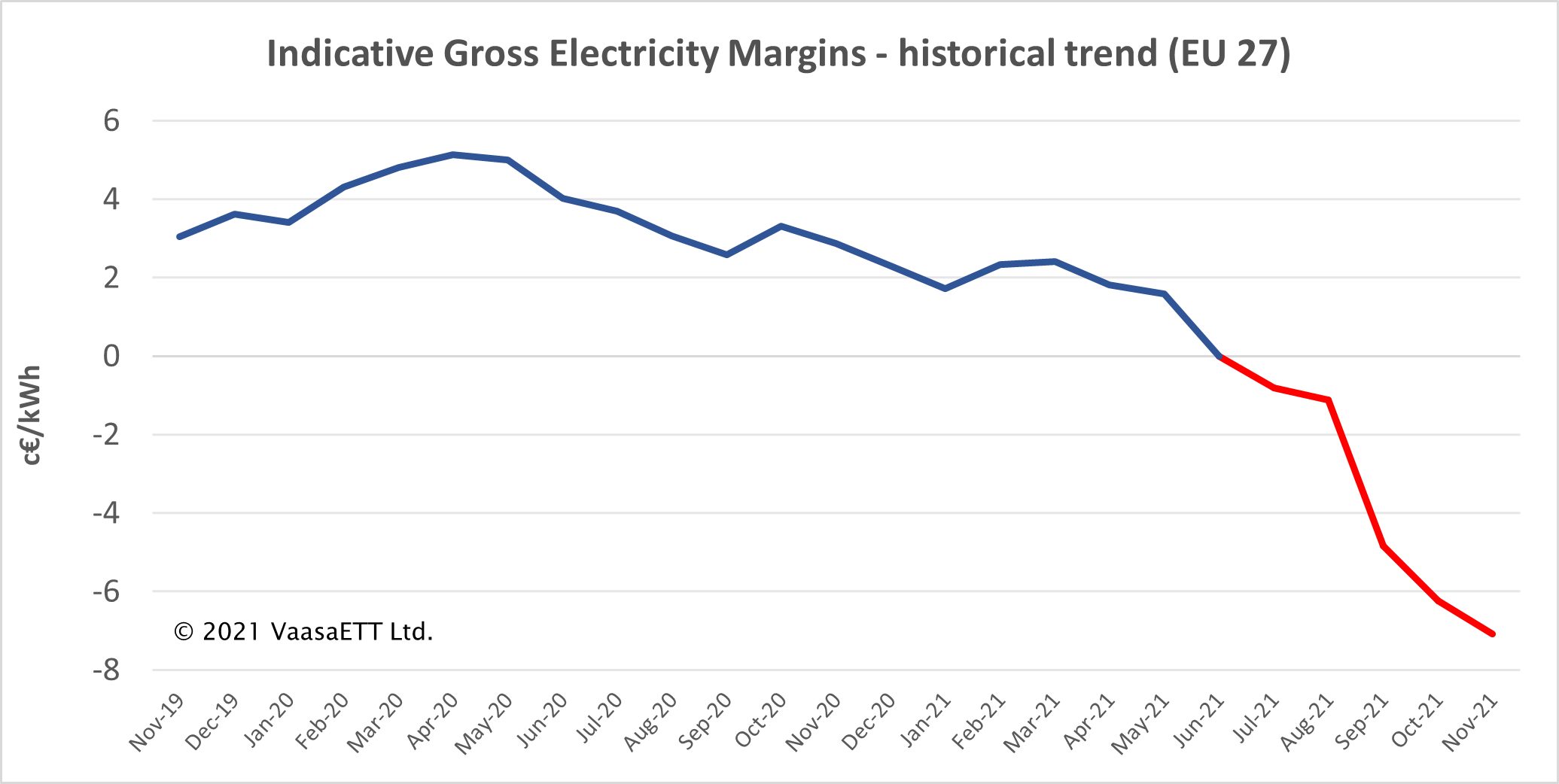

But while consumers are suffering, so too are retailers, especially those which are less well hedged or do not have extensive generation portfolios. Retail energy margins have, contrary to folklore, never been large, but across the EU 27 states, indicative gross margins (the difference between wholesale spot price[2] and retail energy components) have moved into negative territory. In some markets they were negative even before the crisis.

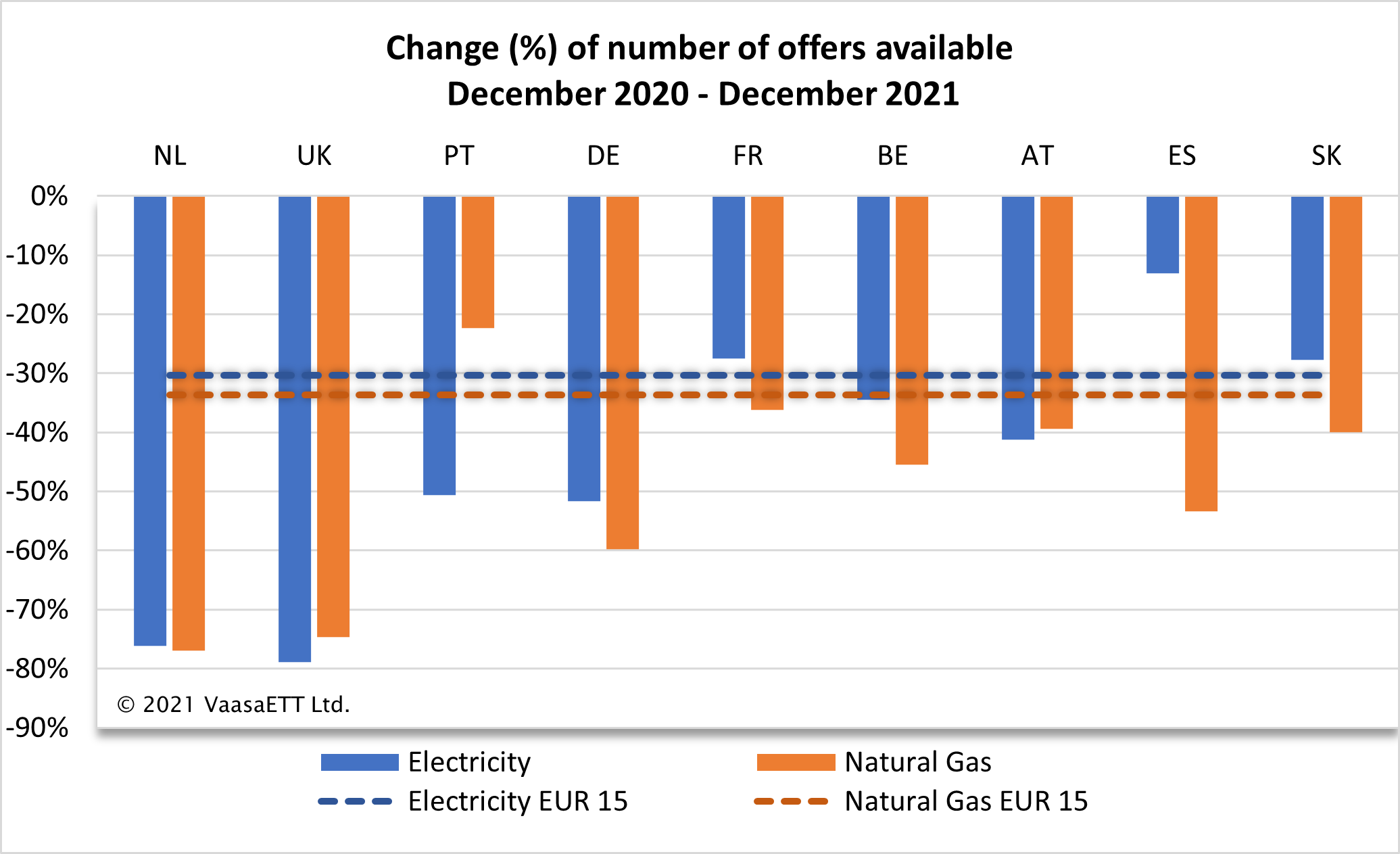

As a consequence, there has been little point – and in some cases it has been impossible – for some competitive retailers to acquire new customers. Comparing December 2021 against a year earlier, the number of offers across EUR 15 markets for instance has fallen by 30-34% (electricity and gas respectively) and in the Netherlands and Great Britain by 76% and 79% (electricity) and 77% and 75% (gas) respectively.

So great has the commercial impact been in some cases that suppliers have paused trading or even failed. While the exit of large numbers of suppliers in Great Britain has been highlighted by the media, suppliers have also failed in other markets and household customers in the EUR 15 capital cities for instance currently have a choice of 23% fewer electricity suppliers and (15% fewer gas suppliers). Ultimately, the options available to European consumers has declined substantially.

The extent to which the changes described here are transient is as yet uncertain. It is fully expected that wholesale prices will fall back, though to what extent and in what time frame is unclear. In any case the inherent risks associated with energy retail have become more apparent through this crisis and it will be interesting to see if more sustainable business practices are adopted, even mandated hereafter. Either way, consumers are likely to be paying more for some time to come.

The Household Energy Price Index (HEPI) is a monthly ranking and analysis of retail electricity and gas prices in 33 European capital cities, conducted by VaasaETT, commissioned by the Austrian energy regulator (Energie-Control) and the Hungarian Energy and Public Utility Regulatory Authority (MEKH). Since January 2009 HEPI has collected prices for EU15 countries and gradually expanded to all of EU Member States, members of the European Energy Community plus Great Britain and Switzerland.

[1] Excluding taxes, based on a weighted household average index.

[2] A 3.5% shaping cost is added to the spot price.

0

0