Electricity network costs have been steadily rising in recent years. This trend is closely linked to the growing investments required to accommodate increasing electrification, integration of renewables and support the broader green transition.

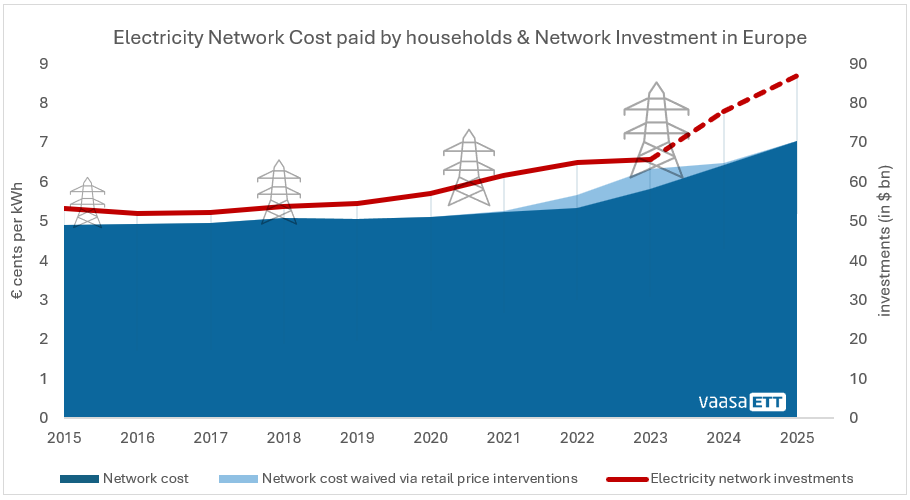

As illustrated by the following graph, European network price increases tend to follow substantial increases in investments with significant delay. Therefore, if estimated recent network investments (dotted red line) are broadly correct, Europe can expect further network price increases of at least 20% over the next couple of years.

What’s more, if we assume at least a doubling of grid investments by 2050 — based, for instance, on ACER’s 2024 monitoring report — we can expect a similar increase in network prices over the same period. In fact, this may be considered a conservative outlook.

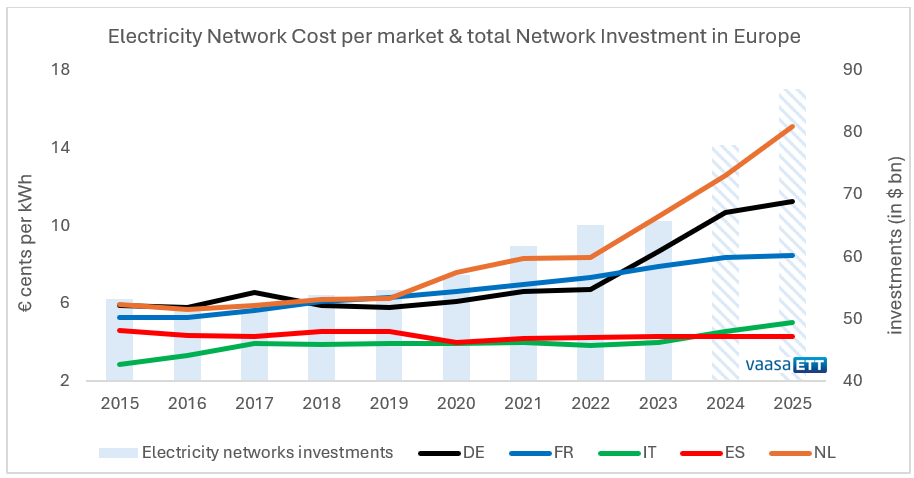

While some markets in Europe, such as the Netherlands (with a correlation of .99 between its network prices and European network investments levels), and to a lesser extent Germany and France follow the broader European trend, some European markets appear to buck the trend.

Spain, for instance, has managed to maintain relatively low grid costs due to capped grid investment (a limit of 0.13% of the country’s GDP) in favour of consumer affordability. Although they now plan to review this cap to align more closely with Europe’s investment strategy. Italy has also kept costs and prices to a lower level.

For those markets that have allowed investment costs, and therefore network prices, to rise substantially, two important questions arise:

1. Have the investments brought more benefits to customers when compared to those markets with lower costs and prices?

2. How can consumers be insulated from major cost increases?

Concerning the former question, the general feeling — even in markets with lower costs —is that major increases in network costs are both inevitable and necessary given the continued push towards the energy transition. However, whether consumers can sense the positive cost-benefit of this spend remains a topic of intense debate in Europe right now.

On the second question, the options seem straightforward: either allow prices to rise or subsidize investments and / or retail prices. During the energy crisis, Europe saw retail price interventions related to waived network costs and in Germany, a $1.4 bn subsidy to cut 2025 electricity network fees has been proposed (prior to the recent elections).

The overall question, however, is perhaps more fundamental — not whether network costs need to increase, but whether the public will breach a threshold for accepting ever-increasing costs.

Source of data for the analysis:

[1] Network cost: Average network cost paid by a typical household in European electricity markets, covers both distribution and transmission charges.

Source: VaasaETT

[2] Network investments: Distribution and transmission grid developments. Other investments related to storage, integration of RES, clean energy, etc are not included.

Sources:

· 2015-2023: IEA World Energy Investment 2023

· 2024-2025: Estimations from different scenarios based on ACER- Electricity infrastructure development to support a competitive and sustainable energy system

0

0